The SID Business Conference took place during Display Week in May 2025 and covered all the key market segments for displays. Ross Young, VP of Counterpoint Research (Ross has announced his retirement recently), gave an in-depth presentation about the market and technology trends in TV, smartphone, automotive, and IT displays with forecasts for the future. Presentations from display industry executives and Counterpoint Research’s analysts at the Business Conference also gave detailed information about current and future trends.

According to Ross’s keynote presentation:

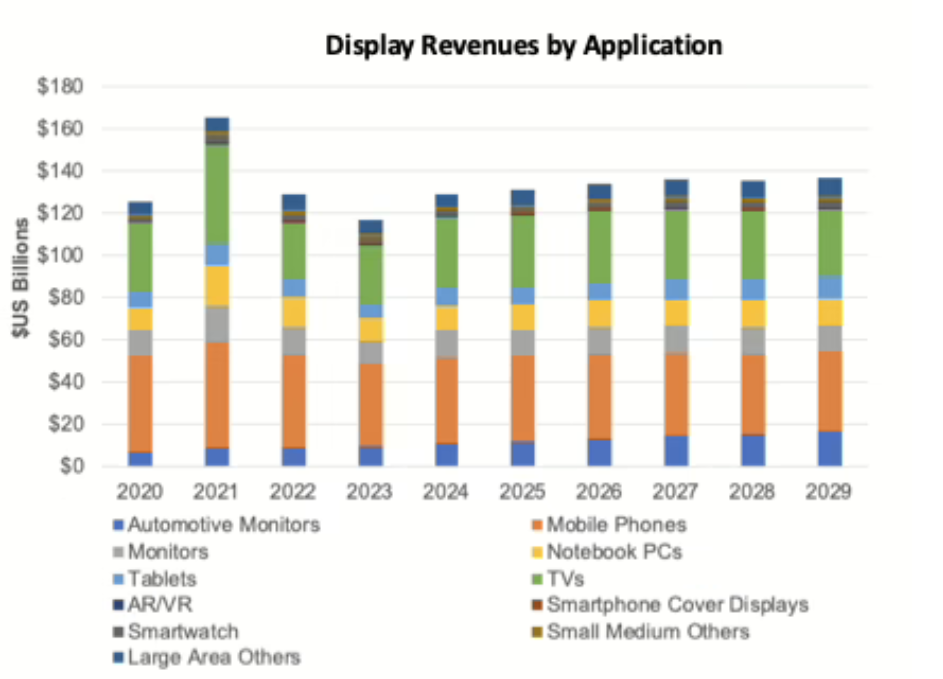

Display Revenues Rebounded in 2024 – Up 11%

Display Revenues by Technology:

Display Revenues by Application:

Richard Kim, SVP of BOE Tech, said in his keynote presentation, “Empowering IoT with display drives premium growth, and 68% of IoT devices have displays.” BOE, the leading LCD supplier, is continuing to develop high-end LCD technology (ADS Pro) solutions and using AI+ for image quality refinement of the display. Eric Cheng, CEO of Tianma America, in his keynote presentation discussed how generative AI is driving changes across the industry, especially in automotive. ChatGPT and DeepSeek are already being used in many cars.

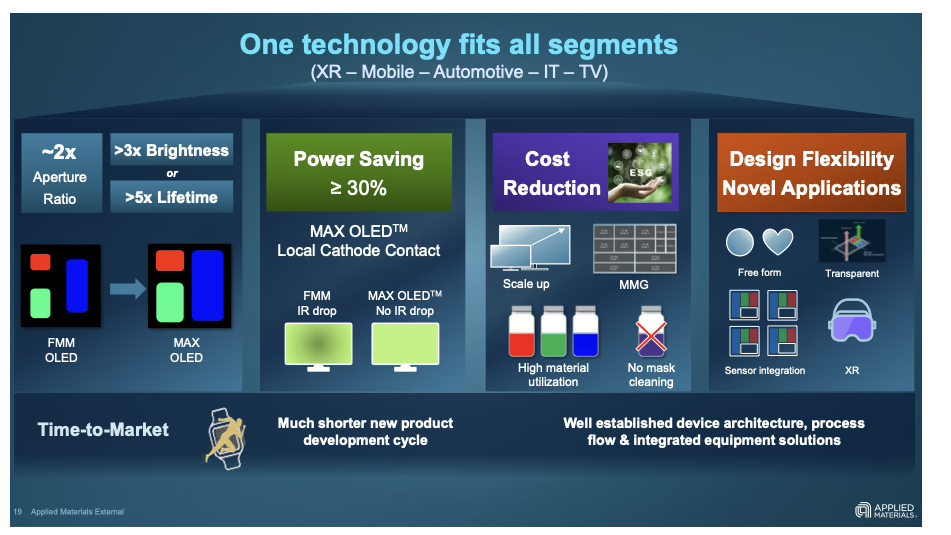

Indrajit Lahiri, Corporate VP of Applied Materials, presented in his keynote, “OLED is primarily adopted in smartphones which have small screens and high ASPs. Breakthrough in OLED scaling is needed to bring OLED to additional markets.” He pointed out that FMM has challenges for small PDL (pixel definition layer) which is needed for higher aperture ratio, and lithography process can deliver it. Applied Materials has introduced MAX OLED solution, a maskless patterning solution using lithography which can enable higher aperture ratio resulting in more than 30% power saving, cost reductions, and design flexibility. It can enable faster time to market as FMM lead time is in months vs. photomask lead time in weeks.

OLED has been gaining only modest unit shares in the IT applications. Cost has been a big challenge. OLED suppliers are planning to shift from Gen 6 to higher Gen 8.7 fabs to lower costs.

As Ross pointed out in his presentation:

Suppliers are now considering photo lithography patterning technology. It has the potential to be used for all applications from MicroOLED to large TV; it could also scale up to Gen10.5 fab. New manufacturing processes will take time to scale and improve yields to reduce costs.

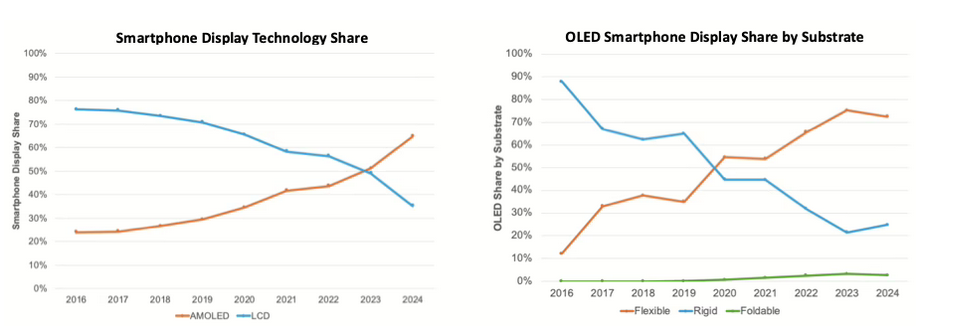

The evolving US tariff situation is impacting smartphone market outlook. Gerrit Schneemann, Senior Analyst at Counterpoint Research, said that “Global smartphone shipment outlook for 2025 was lowered from 4% growth to 1% decline. The primary driver for this decline is the anticipated lower volume in the US.” The situation has reignited efforts to diversify manufacturing away from China. As per Ross Young’s presentation, Smartphone Display Shipments trends:

According to Dr. Mike Hack, VP of Business Development for Universal

Display (UDC)’s presentation, “Key performance metrics of PHOLED is

lifetime. Continuously improving OLED longevity is driving product

innovation, from smartphones and TVs to automotive displays and beyond.”

He presented that UDC’s red and green PHOLED with fluorescent blue has

resulted in 72% reduction in energy consumption for smartphones in 2025

compared to 2015. Full red, green, and blue PHOLED is projected to have

additional ~25% performance improvement in energy consumption for

smartphones compared to prior devices containing fluorescent blue.

LG Display’s press release in May 2025 said: LG Display has become

the world’s first company to successfully verify the

commercialization-level performance of blue phosphorescent OLED panels

on a mass production line, 8 months after partnering with UDC. LG

Display is using a hybrid two-stack Tandem OLED structure, with blue

fluorescence in the lower stack and blue phosphorescence in the upper

stack. The company reported that it consumes about 15% less power. Ross

pointed out in his presentation that besides Phosphorescent Blue,

companies are also working on hyperfluorescence (HF) solutions. Visionox

has launched high-efficiency blue OLED using HF solution with a

fluorescent blue dopant and a TADF sensitizer (10% increase in luminous

efficiency and 22% increase in lifetime). BOE has demonstrated a tandem

TADF HF green solution. Tianma has shown HF green.

Under-panel facial ID and under-panel camera are expected to come in

next-generation smartphones. According to Michael Helander, CEO of OTI

Lumionics presentation, “OTI has developed optimized panel design using

Cathode Patterning to enable under-display 3D facial recognition. Rapid

advances in Generative AI are driving the need for better

authentication. OTI’s CPM technology is mass production qualified for

mobile display manufacturing by multiple leading panel suppliers.”

Technology innovations are needed to drive market demand.

Eric Cheng, CEO of Tianma America, in his keynote presentation said,

“Rapid development of AI accelerates intelligent car evolution.

Automotive intelligence plus AI creates new scenarios for in-vehicle

display applications.” These changes are opening up new application

opportunities for automobile displays requiring bigger and better

displays. Tianma has established itself as the top supplier for

automotive-grade displays. It is focusing on TFT-LCD, OLED as well as

MicroLED displays and offering a multitude of products to serve the auto

market.

Automotive – Shifting to Larger Size, More Advanced Display, LCD Dominant

Name: lily

Mobile:185 7332 9919

Tel:185 7332 9919

Whatsapp:8618573329919

Email:sales@huayuan-lcd.com

Add:Factory No.9, Zhongnan High-tech Intelligent Manufacturing Industrial Park, Tianyuan District, Zhuzhou,Hunan, China, 412000